Condo Insurance in and around Issaquah

Condo unitowners of Issaquah, State Farm has you covered.

Condo insurance that helps you check all the boxes

Condo Sweet Condo Starts With State Farm

As with any home, it's a good plan to make sure you have coverage for your condominium. State Farm's Condo Unitowners Insurance has great coverage options to fit your needs.

Condo unitowners of Issaquah, State Farm has you covered.

Condo insurance that helps you check all the boxes

Why Condo Owners In Issaquah Choose State Farm

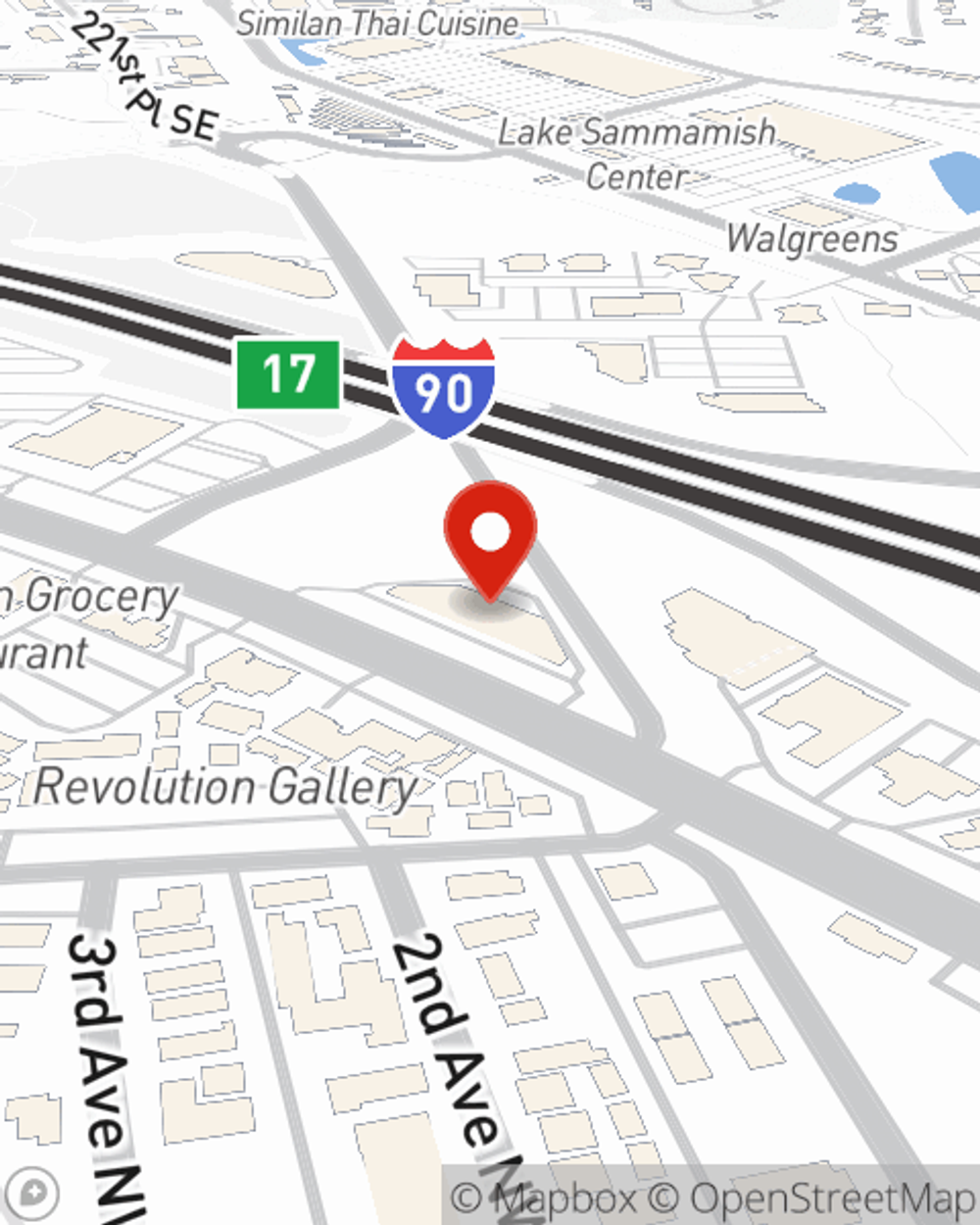

With this coverage from State Farm, you don't have to be afraid of the unforeseen happening to your most personal possessions. Agent Fernando Guaren Jr can help inform you of all the various options for you to consider, and will assist you in building an excellent policy that's right for you.

Finding the right insurance for your condo is made simple with State Farm. There is no better time than today to call or email agent Fernando Guaren Jr and check out more about your fantastic options.

Have More Questions About Condo Unitowners Insurance?

Call Fernando at (425) 392-2224 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Fernando Guaren Jr

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.